Construction spending rallied in January as private nonresidential construction increased for the first time in seven months, according to an analysis of new federal construction spending data by the Associated General Contractors (AGC) of America. Association officials said that nonresidential construction spending remains below pre-pandemic levels and that rising materials prices and proposed labor law changes threaten the sector’s recovery.

“Despite a modest upturn in January, spending on private nonresidential construction remained at the second-lowest level in more than three years and was 10 percent below the January 2020 spending rate,” said Ken Simonson, the association’s chief economist. “All 11 of the private nonresidential categories in the government report were down, compared to a year earlier.”

Construction spending in January totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 1.7 percent from the pace in December and 5.8 percent higher than in January 2020. Residential construction jumped 2.5 percent for the month and 21 percent year-over-year. Meanwhile, combined private and public nonresidential spending climbed 0.9 percent from December but remained 5.0 percent below the year-ago level.

Private nonresidential construction spending rose 0.4 percent from December to January, although declines continued for the three largest components. The largest private nonresidential segment, power construction, fell 10.0 percent year-over-year and 0.8 percent from December to January. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 8.3 percent year-over-year and 1.8 percent for the month. Office construction decreased 4.4 percent year-over-year and 0.2 percent in January. Manufacturing construction tumbled 14.7 percent from a year earlier despite a 4.9 percent pickup in January.

Public construction spending increased 2.9 percent year-over-year and 1.7 percent for the month. Results were mixed among the largest segments. Highway and street construction rose 6.5 percent from a year earlier and 5.8 percent for the month, possibly reflecting unseasonably mild weather conditions in January 2021 compared to December and January 2020. Educational construction increased 0.9 percent year-over-year but dipped 0.1 percent in January. Spending on transportation facilities declined 0.6 percent for the year and 1.0 percent in January.

Private residential construction spending increased for the eighth-straight month, jumping 21 percent year-over-year percent and 2.5 percent in January. Single-family homebuilding leaped 24.2 percent compared to January 2020 and 3.0 percent for the month. Multifamily construction spending climbed 16.9 percent for the year and 0.7 percent for the month.

Association officials said that many construction firms report they are being squeezed by rising materials prices, particularly for lumber and steel, yet are having a hard time increasing what they charge to complete projects. They urged the Biden administration to explore ways to boost domestic supply and eliminate trade barriers for those key materials. They also cautioned that the proposed PRO Act and its significant changes to current labor laws could undermine labor harmony at a time when the industry is struggling to rebound.

“Contractors are getting caught between rising materials prices and stagnant bid levels,” said Stephen E. Sandherr, the association’s chief executive officer. “Add to that the possible threat of a new era of labor unrest, and many contractors are worried that the recovery will end before it really starts.”

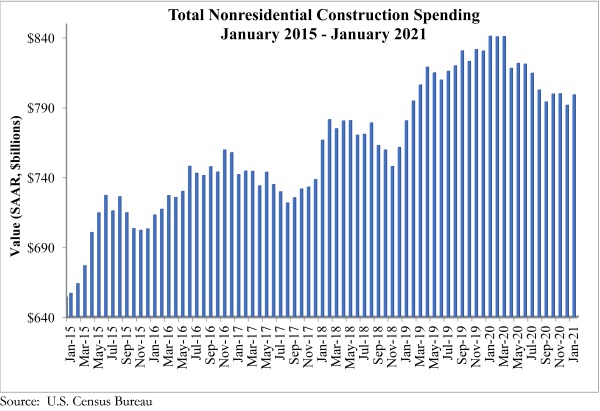

Meanwhile, the Associated Builders and Contractors (AGC) reported that national nonresidential construction spending increased 0.9% on a monthly basis in January 2021 but is down 5% since January 2020, citing an analysis of data published by the U.S. Census Bureau.

On a seasonally adjusted annualized basis, nonresidential spending totaled $799.1 billion for the month.Spending was up on a monthly basis in nine of the 16 nonresidential subcategories. Private nonresidential spending increased 0.4% in January, while public nonresidential construction spending increased 1.6%.

Only four nonresidential construction categories have experienced growth in spending on a year-over-year basis, all of which are primarily publicly financed segments.“It is remarkable that overall nonresidential construction spending has stabilized recently despite the lingering impacts of the COVID-19 pandemic,” said ABC Chief Economist Anirban Basu.

“January 2021’s construction spending data line up with the Construction Backlog Indicator produced by ABC, which indicates that backlog is stabilizing and that many nonresidential contractors expect both sales and staffing levels to expand over the next six months.“There are some key caveats, however,” said Basu. “Private nonresidential construction remains soft in the context of compromised commercial real estate fundamentals. Construction spending in the lodging segment is down nearly 23% over the past year, and office construction spending is down both on both a monthly and yearly basis.

“The trajectory of remote work, business travel and brick-and-mortar retail is still uncertain, so construction spending in a large number of private categories is poised to remain soft for the foreseeable future.“There is at least one additional consideration that serves as a bit of a damper in what was an otherwise decent construction spending report for January,” said Basu.

“The rise in construction spending in January could largely reflect rising materials prices and efforts by contractors to pass at least some of those increases to purchasers of construction services. It comes as little surprise that many of the contractors who expect rising sales and staffing levels during the first half of 2021 also anticipate shrinking margins.”