North Carolina’s construction employment has grown by about 4 percent in the 16 months since the COVID-19 pandemic started, but there are significant market variations with some experiencing greater growth, and others suffering significant job losses.

Data compiled by the Associated General Contractors (AGC) of America from government sources shows, for example, an eight percent growth in Durham/Chapel Hill area, compared to a 2 percent growth in metropolitan Charlotte. However, employment declined by 6 percent in Fayetteville.

Overall, the state gained 8,700 jobs increasing from 231,400 to 240,100. Data for smaller communities reflects mining and logging in the totals.

See the data by community below:

Numbers employed Feb. 2020; June 2021; change in past 16 months; percentage change in the past 16 months, national rank

- Statewide Construction 231,400 240,100 8,700 4%

- Statewide Mining, Logging, and Construction 237,200 245,800 8,600 4%

- Asheville Mining, Logging, andConstruction 9,500 9,800 300 3% 223

- Burlington Mining, Logging, and Construction 3,200 3,400 200 6% 183

- Charlotte-Concord-Gastonia, NC-SC Mining, Logging, and Construction 69,100 70,200 1,100 2% 235

- Durham-Chapel Hill Mining, Logging, and Construction 9,200 9,900 700 8% 154

- Fayetteville Mining, Logging, and Construction 5,300 5,000 -300 -6% 321

- Greensboro-High Point Mining, Logging, and Construction 15,900 16,600 700 4% 213

- Greenville Mining, Logging, and Construction 3,400 3,300 -100 -3% 301

- Hickory-Lenoir-Morganton Mining, Logging, and Construction 4,700 5,100 400 9% 137

- Raleigh Mining, Logging, and Construction 42,200 44,200 2,000 5% 197

- Rocky Mount Mining, Logging, and Construction 2,500 2,600 100 4% 213

- Wilmington Mining, Logging, and Construction 9,600 10,100 500 5% 197

- Winston-Salem Mining, Logging, and Construction 11,700 12,100 400 3% 223

- Myrtle Beach-Conway-North Myrtle Beach, SC-NC Mining, Logging, and Construction 10,800 11,700 900 8% 154

- Virginia Beach-Norfolk-Newport News, VA-NC Mining, Logging, and Construction 39,100 40,500 1,400 4% 213

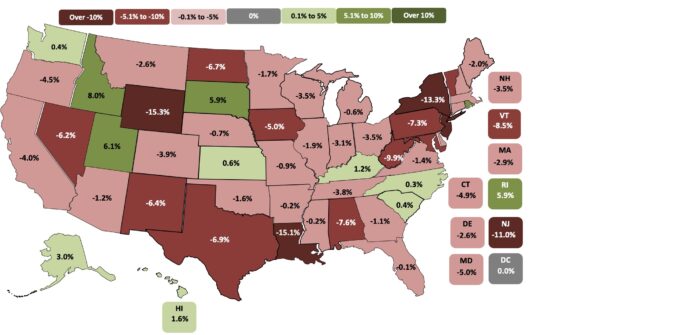

Nationally, construction employment declined or stagnated in 101 metro areas between February 2020 and June 2021, AGC reported in its July 28 analysis.

Association officials said that labor shortages and supply chain problems were keeping many firms from adding workers in many parts of the country.

“Typically, construction employment increases between February and June in all but 30 metro areas,” said Ken Simonson, the association’s chief economist. “The fact that more than three times as many metros as usual failed to add construction jobs, despite a hot housing market, is an indication of the continuing impact of the pandemic on both demand for nonresidential projects and the supply of workers.”

Eighty metro areas had lower construction employment in June 2021 than February 2020, while industry employment was unchanged in 21 areas. Houston-The Woodlands-Sugar Land, Texas lost the most jobs: 33,400 or 14 percent. Major losses also occurred in New York City (-22,000 jobs, -14 percent); Midland, Texas (-9,300 jobs, -24 percent); Odessa, Texas (-7,900 jobs, -38 percent) and Baton Rouge, La. (-7,700 jobs, -16 percent). Odessa had the largest percentage decline, followed by Lake Charles, La. (-34 percent, -6,700 jobs); Laredo, Texas (-25 percent, -1,000 jobs); Midland; and Longview, Texas (-22 percent, -3,300 jobs).

Of the 257 metro areas—72 percent—added construction jobs over the February 2020 level, Chicago-Naperville-Arlington Heights, IL. added the most construction jobs over 16 months (14,300 jobs, 12 percent), followed by Minneapolis-St. Paul-Bloomington, Minn.-Wis. (13,800 jobs, 18 percent); Indianapolis-Carmel-Anderson, Ind. (10,700 jobs, 20 percent); Warren-Troy-Farmington Hills, Mich. (9,300 jobs, 18 percent); and Pittsburgh, Pa. (7,600 jobs, 13 percent). Fargo, N.D.-Minn. had the highest percentage increase (50 percent, 3,700 jobs), followed by Sierra Vista-Douglas, Ariz. (48 percent, 1,200 jobs); Bay City, Mich. (45 percent, 500 jobs); St. Cloud, Minn. (39 percent, 2,400 jobs) and Kankakee, Ill. (36 percent, 400 jobs).

Association officials urged Congress and the Biden administration to make new investments in workforce development and to take steps to address supply chain issues. “They called for additional funding for career and technical education; they noted that craft training receives only one-sixth as much federal funding as college preparation.” They also continued to call on the president to remove tariffs on key construction materials like steel and aluminum.

“Federal officials may talk about the value of craft careers like construction, but they are failing to put their money where their mouth is,” said Stephen E. Sandherr, the association’s chief executive officer. “Until we expose more people to construction careers, and get a handle on soaring materials prices, the construction industry is likely to have a hard time recovering from the pandemic.”